2024 in review: Clairfield tops best ever deal record, expands, and celebrates

Clairfield International is proud to reflect on a remarkable 2024, marked by an unprecedented performance, expansion across key markets, and a major milestone — our 20th anniversary. With 236 transactions completed in 2024 and top positions in the latest M&A rankings by LSEG, we remain a trusted partner for companies pursuing midmarket transactions. Our anniversary was celebrated with a memorable event in Paris, where Clairfield’s global partners gathered to honour the past two decades of partnership and success.

This 20th anniversary year was accompanied by record-breaking transaction activity, with a cumulative deal value of over EUR 14.5 billion. Our 2024 deal highlights span industries and geographies, showcasing our strength across borders:

The sale of Hruška, spol. s r.o., a grocery retailer, and its real estate arm Sempronemo s.r.o. to Central European Retail Holding, owned by private equity fund Oriens in Budapest and Prague.

The acquisition of Mühle Runingen by Dossche Mills, advised jointly by our Belgian and German teams.

The landmark delisting of Barloworld Limited, which at approximately EUR 950 million in value is one of the largest industrial sector transactions in South Africa in the past decade.

The crossborder acquisition of WSiP in Poland by Infinitas Learning advised by our Polish and Dutch teams.

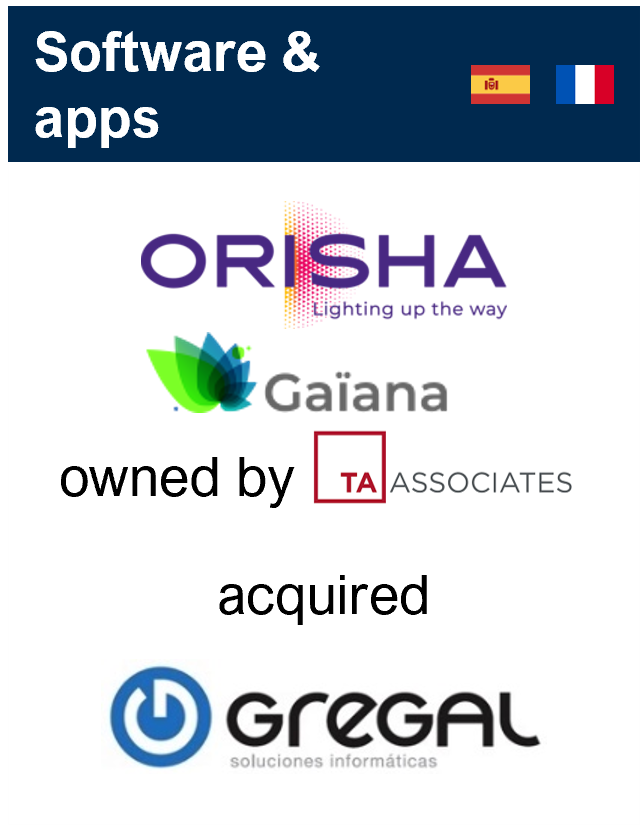

Three acquisitions by Gaiana, an agricultural software company backed by Orisha, advised by our French and Spanish teams.

Two disposals on behalf of GALERIA Karstadt Kaufhof, one of which involved multiple regions and won Best Mid-Cap Corporate Deal at the 2024 M&A Awards.

These deals, among many others, earned Clairfield a leading position in the LSEG league tables. In addition to our longstanding position at the top of the tables for Europe and Latin America, we are delighted to have achieved top ten placements in Italy, Japan, Sub-Saharan Africa, and South Africa. Clairfield is among the top three firms in Eastern Europe, and in the top twenty worldwide. We are proud to be ranked among the leading financial advisors globally, reflecting the trust placed in us by clients across sectors and regions.

Expansion in Africa and Latin America

Clairfield takes great pride in the top quality of our advisory services and our expertise in closing complex, value-creating transactions across key geographies. In 2024 we expanded our global reach with the addition of two exceptional firms to our international team.

Our exclusive partnership with RMB headquartered in Johannesburg, the corporate finance arm of FirstRand, the top African bank by market cap, marks our first entry into Africa. With deep expertise across sectors such as mining, consumer products, and energy, RMB provides unrivalled access to South Africa, Nigeria, and other Sub-Saharan markets. Our partnership with RMB has already opened doors to mandates in these resource-rich markets.

We also welcomed First Capital, Argentina’s foremost corporate finance firm with a presence in Panama and Uruguay, further strengthening our coverage in Latin America and enhancing our established operations in Mexico and Brazil, particularly in sectors such as agribusiness and resources. First Capital also offers significant debt and company restructuring expertise.

We are proud to reflect on two decades of partnership and growth, with 2024 marking an exceptional year of performance across our global team. Our commitment to fostering top talent was demonstrated by the continued success of the Clairfield Academy, which supports the development of highly skilled M&A professionals.

We also expanded our capabilities in our debt advisory practice where Bénédicte Leneveu became co-head of our debt advisory practice alongside Hans Buysse and our Italian partner EQUITA strengthened its services with the acquisition of CAP Advisory, further enhancing our debt advisory expertise in Europe.

As we look ahead to 2025, we remain focused on delivering value-driven advisory services. We are grateful to our clients, partners, and colleagues for their continued trust and collaboration and look forward to another successful year.

See the LSEG Global M&A 2024 league tables here: midmarket / smallcap / emerging markets.